Retail’s Strong 2025 Start Hits a Freeze (Both in Weather and Sales) in February

Retail Council of Canada (RCC) and Moneris® Data Services have teamed up to deliver Canadian credit and debit spending data, along with consumer insights, to help the retail industry better understand consumer behaviour and spending trends across both national and provincial levels.

Each quarter, Retail Council of Canada surveys executive members from mid-large sized retailers from coast to coast to obtain an insider’s perspective on retail performance for the past quarter. RCC does not present the results as a statistically representative analysis but rather a retail pulse to help provide context around trends impacting the industry. Respondents from the gas, motor vehicles or grocery sectors are not included in the survey.

The following commentary is an excerpt of the report covering the period of December 2024-February 2025.

Overview

Retailers started 2025 strong, but February’s deep freeze—both in weather and sales—wiped out early momentum. Only 35% of retailers reported year-over-year gains. Discretionary spending had been rising, driven by easing inflation and better housing affordability, supported by a “normal” Canadian winter. But a double hit of harsh winter storms and fresh U.S. trade threats quickly cooled consumer confidence.

Despite these headwinds, 75% of retailers remain cautiously optimistic for 2025, with the year holding steady or seeing slight gains over 2024. They’re adjusting strategies, bracing for volatility, and closely monitoring consumer behaviour.

Key Insights:

Retail Sales

Retailers we spoke with wrapped up the holidays strong, with a solid December finish, a solid Boxing Day, and a surprisingly strong January.

The GST Holiday had little impact outside of restaurants, and by February, consumers tightened their wallets.

Consumer Behaviour and Spending Trends

Despite reports suggesting otherwise, for many of the retailers we spoke to, January was a surprisingly strong month.

- Consumer confidence rises, but spending stays cautious. Consumers felt more optimistic about housing affordability, with national rental rates hitting an 18-month low and the Bank of Canada cutting interest rates again. Inflation was a mixed bag—higher energy costs offset the broad benefits of the GST Holiday, but the only sector to see any meaningful boost was restaurants. While the inflation battle may be turning, it’s far from over.

- Boxing Day was solid for retailers, but foot traffic takes a dip. For retailers who took part, Boxing Day delivered—most said sales met or exceeded expectations. However, it still lagged behind Black Friday in both sales volume and shopper excitement. Foot traffic, however, dipped, with the RCC Retail Pulse Dashboard showing a 4-6% decline in most provinces and a double-digit drop month-over-month—an expected slowdown following the holiday season.

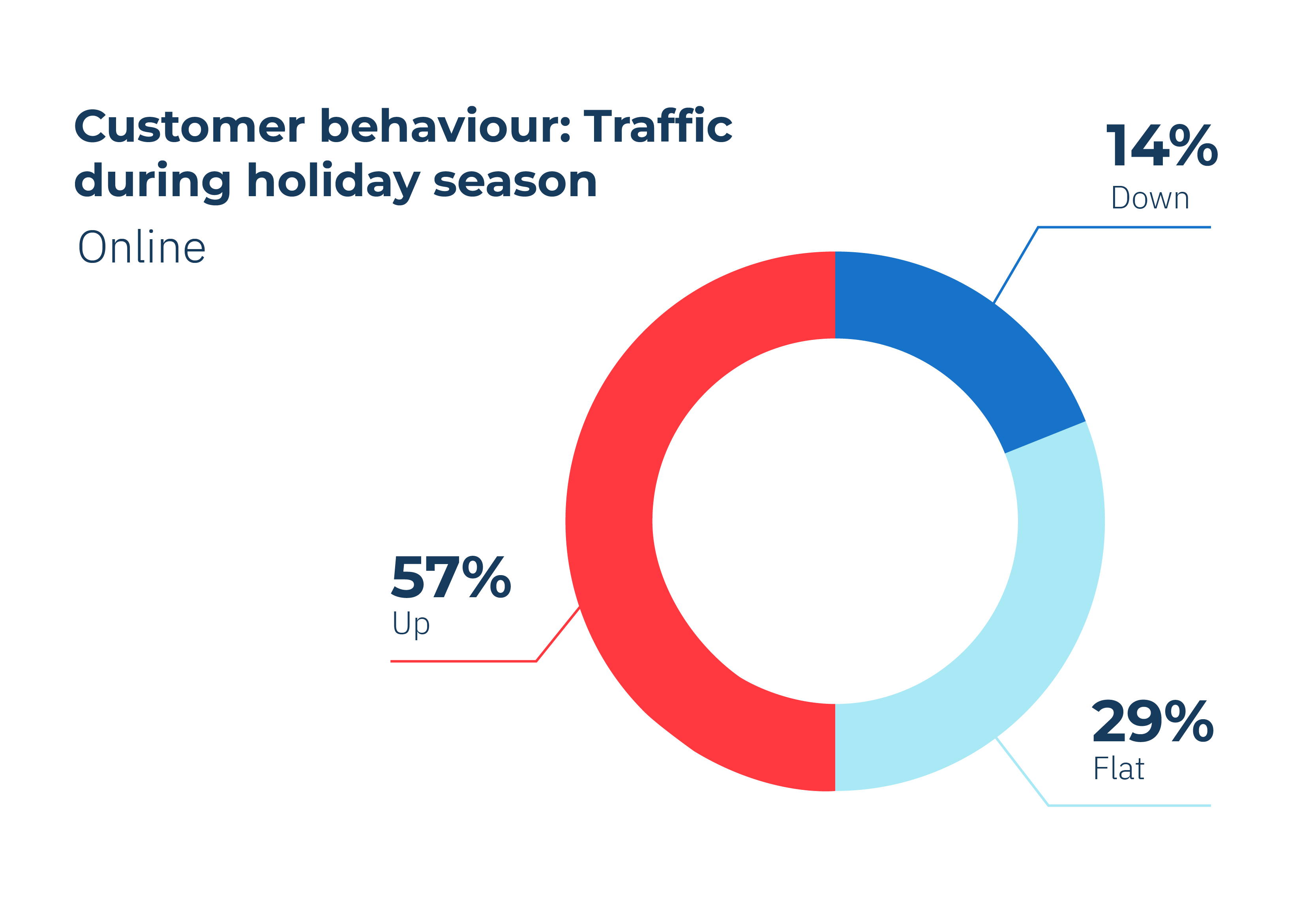

- E-Commerce: Faster, more convenient—but basket sizes shrink. Online shopping remained stable, with 57% of retailers we spoke to reporting increased traffic and 64% seeing higher e-commerce sales. Despite this, many retailers still struggle to make e-commerce profitable. Retailers also reported a growing consumer and business focus on ultra-fast same-day delivery. Many retailers see same-day fulfillment from local stores as a competitive advantage, and consumers are willing to pay for the convenience. However, single-item purchases don’t boost overall basket size, making it a double-edged sword for retailers.

Retailer Sentiments and Strategies

- Retailers are prepared to pivot—again. Having mastered resilience, adaptability, and rapid decision-making during the pandemic, retailers are once again putting those skills to the test. The ability to navigate disruption—by staying agile, diversifying suppliers, and controlling costs—has never been more critical.

- A cautious 2025 outlook—a smart move. Retailers entered 2025 with a measured approach, and that restraint may prove essential. With mounting economic pressures, conditions could worsen beyond initial expectations. By staying flexible, managing risk, and holding back on major investments, the retailers we spoke with are keeping options open in an unpredictable market.

About Retail Council of Canada

Retail is Canada’s largest private-sector employer with over 2 million Canadians working in our industry. Retail Council of Canada (RCC) is a not-for-profit industry-funded association that represents small, medium, and large retail businesses in every community across the country. As the Voice of Retail™ in Canada, RCC proudly represents more than 45,000 storefronts in all retail formats, including department, grocery, specialty, discount, independent retailers, and online merchants.

Interested in membership, then please visit here or contact [email protected].