Consumers Open Wallets, Return to Stores and Start Shopping Again in Spring 2025

Retail Council of Canada (RCC) and Moneris® Data Services have teamed up to deliver Canadian credit and debit spending data, along with consumer insights, to help the retail industry better understand consumer behaviour and spending trends across both national and provincial levels.

Each quarter, Retail Council of Canada surveys executive members from mid-large sized retailers from coast to coast to obtain an insider’s perspective on retail performance for the past quarter. RCC does not present the results as a statistically representative analysis but rather a retail pulse to help provide context around trends impacting the industry. Respondents from the gas, motor vehicles or grocery sectors are not included in the survey.

The following commentary is an excerpt of the report covering the period of March to Mid-May 2025.

Key Insights:

Retail Sales

80% of retailers experienced year-over-year sales gains through late spring. Retailers we spoke to are sticking to their modest 2025 growth and marketing plans, despite uncertainty around tariffs, supply chains, recession risk and low consumer confidence—with recent comp-store gains keeping concerns in check for now.

- The May long weekend capped off a strong spring, with 67% of retailers reporting improved sales versus the same time last year.

- 80% reported year-over-year growth in margin dollars, and 56% saw improved margin percentages—gains largely driven by reduced promotional activity and more strategic decisions around mix and assortment.

Consumer Behaviour and Spending Trends

Most retailers were encouraged by a sharp turnaround following a sluggish start to the year—despite a cool May dampening seasonal sales.

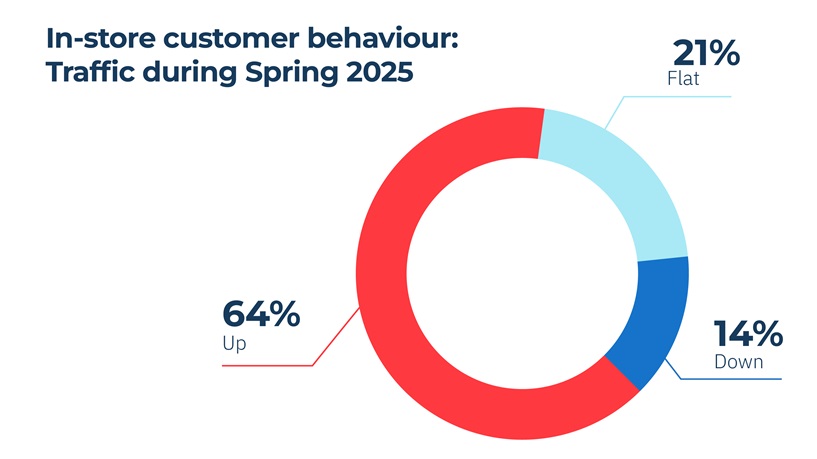

-

Average transaction value rose for 80% of respondents.

-

Basket size held steady or increased for nearly 70%.

-

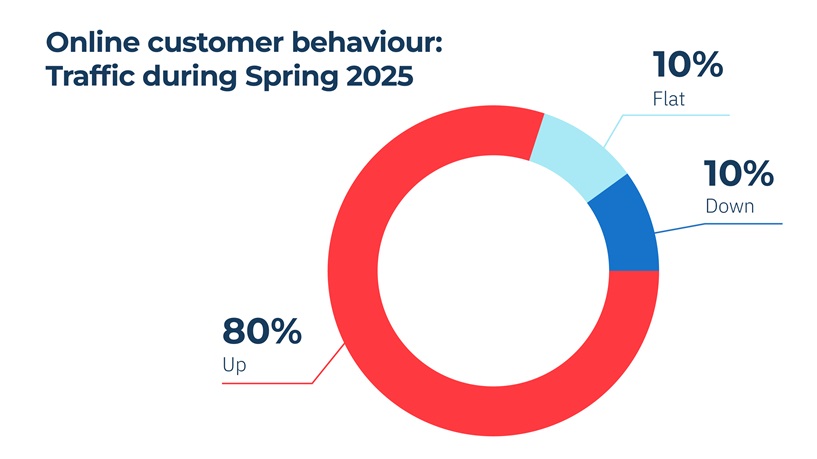

Web traffic also climbed for 80% of retailers, though conversion and sales performance showed a more mixed picture.

Three majors shifts reshaped the Canadian retail landscape in early 2025:

-

The closure of Peavey Mart’s 90 stores

-

The liquidation of Hudson’s Bay, Saks Fifth Avenue, and Saks Off Fifth

-

Rise of patriotic shopping

These exits open the door to new retail opportunities—from capturing market share and talent to welcoming new brands. Yet challenges remain, especially with the loss of key mall anchors, Hudson’s Bay and Saks Fifth Avenue, which has left gaps in malls and access points. As landlords and retailers adapt, the stage is set for bold moves and fresh growth across the sector.

While the May long weekend met expectations for most retailers, cool, wet weather dampened results for seasonal and home improvement categories. Looking ahead, retailers remain cautiously optimistic for summer and are planning for flat to modest growth heading into Back-to-School.

Online shopping remained stable, with 80% of retailers we spoke to reporting increased traffic and 77% seeing higher ecommerce sales.

Retailer Sentiment: Cautious Optimism in a Shifting Landscape

- Retailers are holding to their 2025 (modest) growth and marketing plans. Retailers acknowledge there is a fair bit of uncertainty in the back half of the year with reciprocal tariffs, supply chain challenges, a risk of recession and low consumer confidence numbers, but not enough firm data to crystalize that risk, particularly considering the past three months of positive comp-store sales numbers.

- Embracing Canadian identity. Amid rising consumer preference for homegrown products over American alternatives, retailers in Canada continued to lean into their national identity, benefiting from a modest tailwind in consumer sentiment.

About Retail Council of Canada

Retail is Canada’s largest private-sector employer with over 2 million Canadians working in our industry. Retail Council of Canada (RCC) is a not-for-profit industry-funded association that represents small, medium, and large retail businesses in every community across the country. As the Voice of Retail™ in Canada, RCC proudly represents more than 45,000 storefronts in all retail formats, including department, grocery, specialty, discount, independent retailers, and online merchants.

Interested in an RCC membership? Please visit here or contact [email protected] for more information.