Retail’s Summer Surge: Strong Sales and Healthy Margins Define 2025 Season

Retail Council of Canada (RCC) and Moneris® Data Services have teamed up to deliver Canadian credit and debit spending data, along with consumer insights, to help the retail industry better understand consumer behaviour and spending trends across both national and provincial levels.

Each quarter, Retail Council of Canada surveys executive members from mid-large sized retailers across Canada to obtain an insider’s perspective on retail performance for the past quarter. RCC does not present the results as a statistically representative analysis but rather a retail pulse to help provide context around trends impacting the industry. Respondents from the gas, motor vehicles or grocery sectors are not included in the survey.

The following commentary is an excerpt of the report covering the period of June to August 2025.

Key Insights:

Retail Sales and Margins

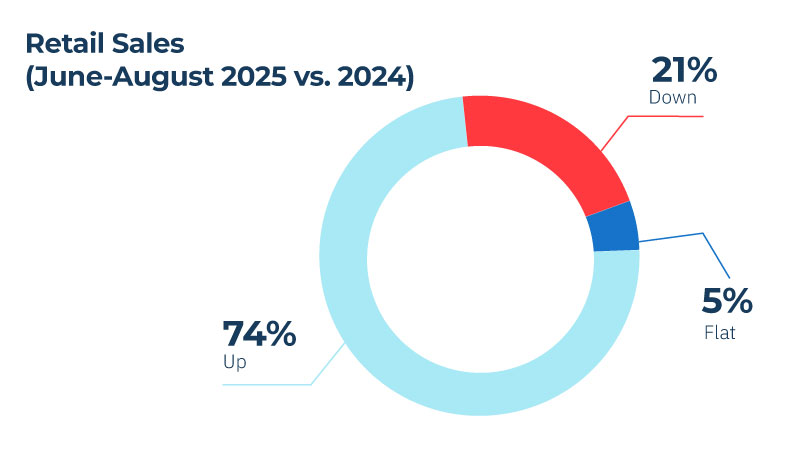

- Solid summer sales set positive tone for 2026: 79% of retailers reported flat or higher sales from June through August compared with last year. Momentum is expected to hold through the rest of 2025, with nearly all respondents projecting flat or positive year-end results.

- Although 2026 budgets are still in development, many retailers are planning for 3–5% sales growth—signaling confidence in the market despite economic uncertainty.

- Stronger margins and a promising start to Fall: 83% of retailers saw margin gains in July, thanks to moderating supply chain costs, better inventory discipline, and more targeted price promotions.

- Yet basket sizes dropped for 41%, squeezing revenue even as traffic and conversions improved. Retailers are doubling down on sharp pricing, targeted promotions, and precise inventory planning to protect profitability through 2025.

- Back-to-school performance: Retailers report that a back-to-school retail event met or exceeded their expectations in August and early September, with several weeks of the season still to go.

Consumer Behaviour and Spending Trends

-

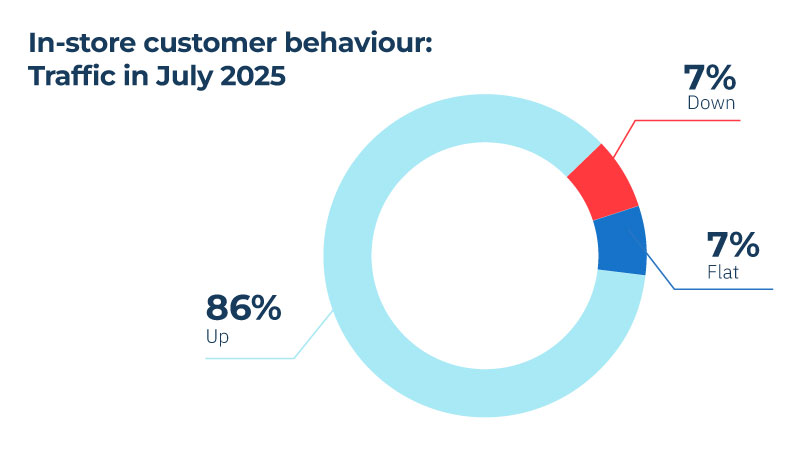

Consumers showed up this summer: 86% of retailers reported higher traffic (often measured by transactions) than last year, and conversions were up too —driving strong in-store sales.

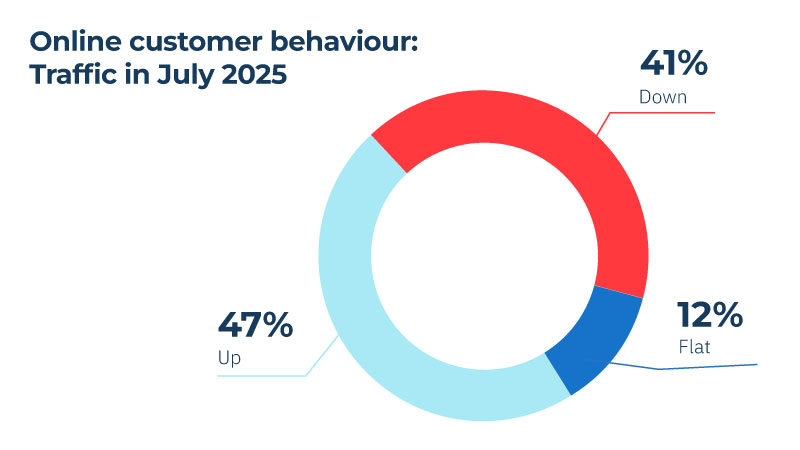

- Clicks dip, carts fill: Web traffic was weaker, with 41% of retailers reporting a drop. The cause? Still unclear. Some suspect AI search platforms may be siphoning link-based traffic away from retail sites. The good news: conversions were up for 73% of retailers, and 67% reported higher online sales—proof that engaged shoppers are buying once they arrive.

- Store consolidation is reshaping shopping patterns: With Nordstrom, Hudson's Bay Company, Peavey Mart and others closing or shrinking, consumers are funneling spending to fewer retailers—especially in mid-market apparel, where department stores once dominated.

Retailer Sentiment: Confident but Cautious as Year Progresses

- Retailers remain cautiously optimistic, holding moderate growth forecasts for 2025–2026.

- Capital projects are slowed, but strategies emphasize agility, sharper pricing, flexible assortments, and customer-first execution.

About Retail Council of Canada

Retail is Canada’s largest private-sector employer with over 2 million Canadians working in our industry. Retail Council of Canada (RCC) is a not-for-profit industry-funded association that represents small, medium, and large retail businesses in every community across the country. As the Voice of Retail™ in Canada, RCC proudly represents more than 45,000 storefronts in all retail formats, including department, grocery, specialty, discount, independent retailers, and online merchants.

Interested in an RCC membership? Please visit here or contact [email protected] for more information.