2025 holiday season in review: Key trends that shaped the season

Holiday shopping is changing. Canadians are still celebrating, but they are doing it with more intention. Rising costs and shifting priorities mean shoppers are looking for value, planning purchases carefully, and spreading spending across more transactions. For retailers, this means the holiday season is no longer about one big rush, but it’s about understanding when and how customers choose to buy and being ready to meet them with the right offer at the right time.

Moneris data shows how Canadians shopped during the holidays. Discover when spending peaked, where activity grew, and how shopper habits shifted. Use these insights to plan your next holiday playbook.

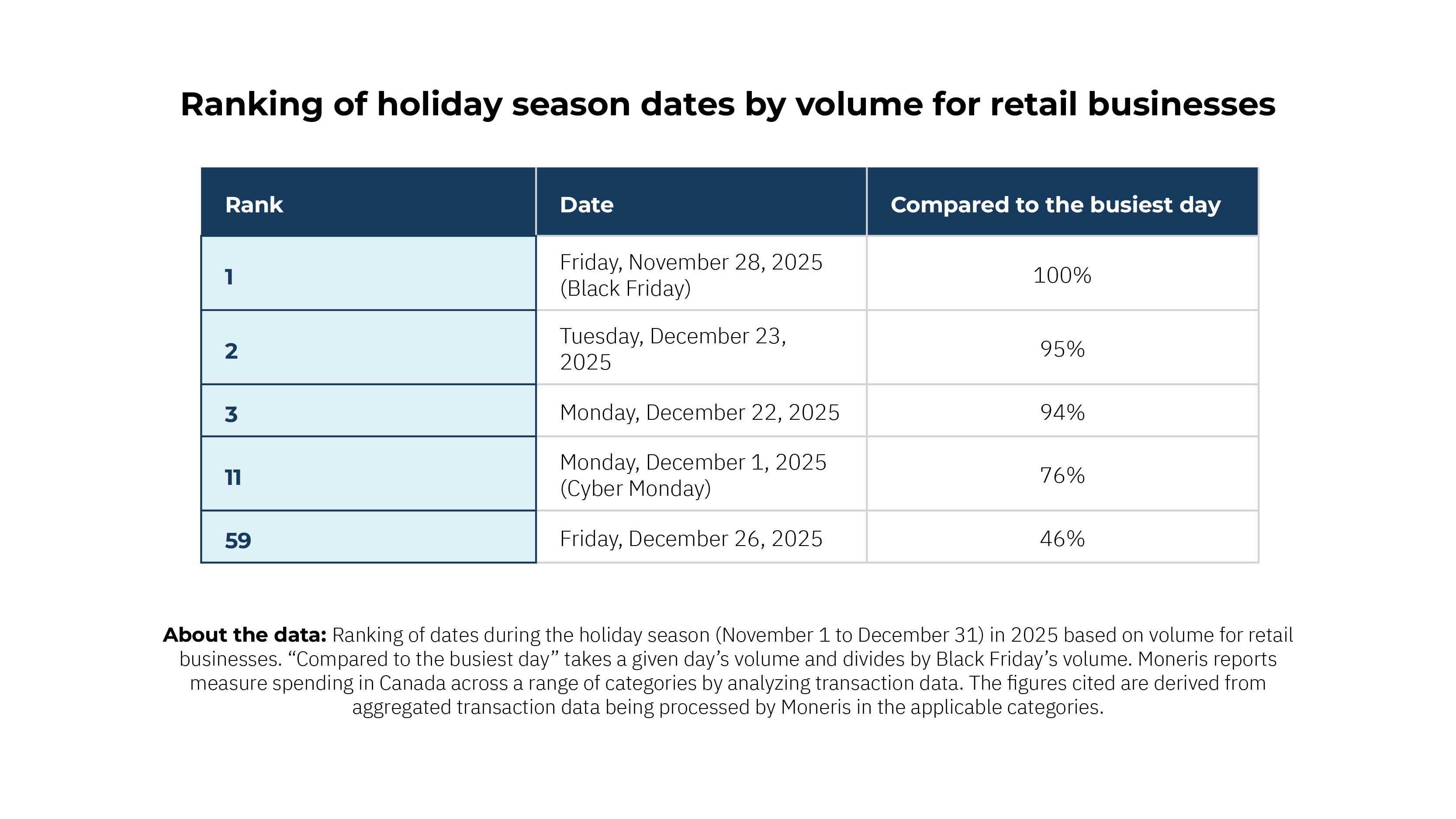

Moments that mattered: Peak shopping days

Holiday spending in 2025 clustered around a few high‑impact days. Prepare your teams and offers for these surges.

-

Black Friday led the season for overall volume

-

December 23 reached 95 per cent of Black Friday volume, driven by last‑minute gift buying

-

December 22 reached 94 per cent of Black Friday volume as shoppers finalized purchases

-

Cyber Monday ranked eleventh, generating about 79 per cent of Black Friday volume, showing continued relevance

-

The quietest days fell after Christmas, before seasonal promotions restarted

-

Boxing Day underperformed again, with less than half of Black Friday volume in 2025

Tips for your business

-

Staff up and extend hours for the final 72 hours before December 25

-

Lock pricing and inventory for Black Friday and the December 22 to 23 window

-

Keep web and mobile queues stable on Cyber Monday, but right size spend and service levels

-

Shift Boxing Day expectations toward targeted clearance and inventory recovery

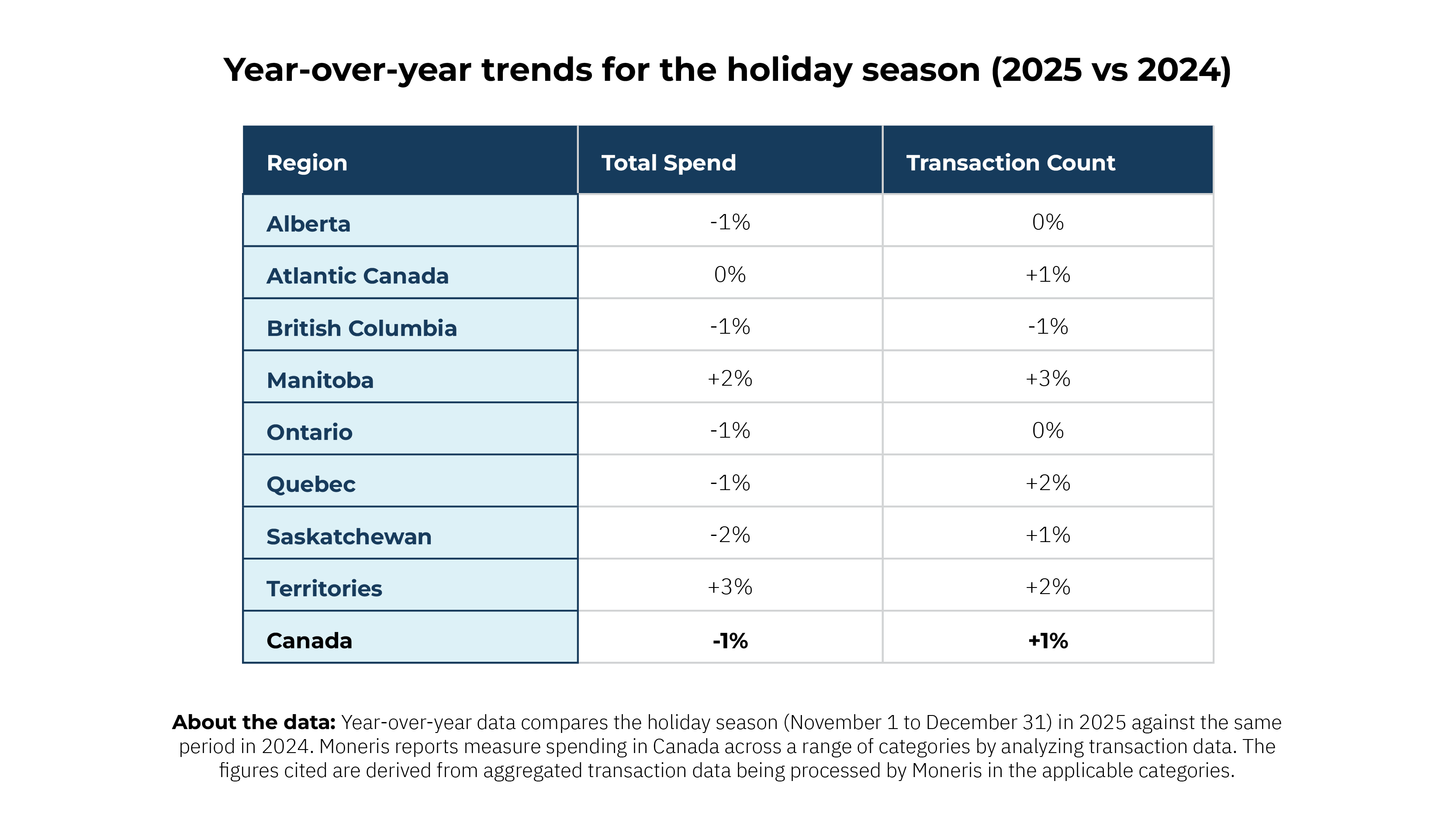

Regional standouts: Manitoba leads growth

Performance varied by region. Target support where transaction activity is growing.

-

Manitoba noted spend volume up a little over 2 per cent year over year and transaction count up 3 per cent

-

The Territories recorded the largest relative gains in transaction count at 3 per cent, with volume up more than 2.5 per cent

-

Atlantic Canada saw modest gains in transaction counts, with volume broadly stable

-

These results show regional resilience even as national spending was softer

Learnings for your business

-

Tailor promotions and staffing to provincial trends, not national averages

-

Expand targeted offers in Manitoba and the Territories to support momentum

-

In Atlantic Canada, focus on frequency drivers such as bundles and low‑friction checkout

A more selective season: Value‑conscious shopping

National holiday spend was relatively flat in 2025, down just under 1 per cent year-over-year. Transaction counts rose modestly, shoppers made more purchases, but with lower average ticket sizes. Budgets faced pressure from inflation, higher living costs and changing confidence.

-

Customers stayed engaged but favoured smaller, measured purchases

-

Stable transaction activity with softer spend points to deliberate, value‑focused behaviour

-

Shoppers prioritized necessity and affordability

Insights for your business:

-

Lead with clear value, price transparency and meaningful bundles

-

Highlight essentials and trusted gifts across price tiers

-

Use smaller basket incentives, such as threshold shipping or add‑on savings

-

Optimize inventory for fast movers in the final week before December 25

Why this matters for your 2026 plan

You need to be ready for multiple demand spikes. Front load for Black Friday. Double down on December 22 and 23. Maintain a lean, reliable plan for Cyber Monday. Reframe Boxing Day around clearance and service recovery. Calibrate regional tactics to where activity is growing. Keep value at the centre of your offers and messaging. This approach helps you match shopper behaviour, protect margins and serve customers well throughout the season.

Reflecting on 2025 with Sean McCormick: A flat holiday spend and its implications data

Data expert Sean McCormick joins Al to break down the latest holiday consumer spending trends. Was spending up, down, or flat this year? Which provinces came out on top? Which days saw the highest activity, and has Boxing Day lost its traditional shopping momentum? Get these answers and more in the full conversation.

Turn insights into action with Moneris Data Services. Visit Moneris Data Services today to explore solutions that help you make smarter, data-driven decisions for your business.