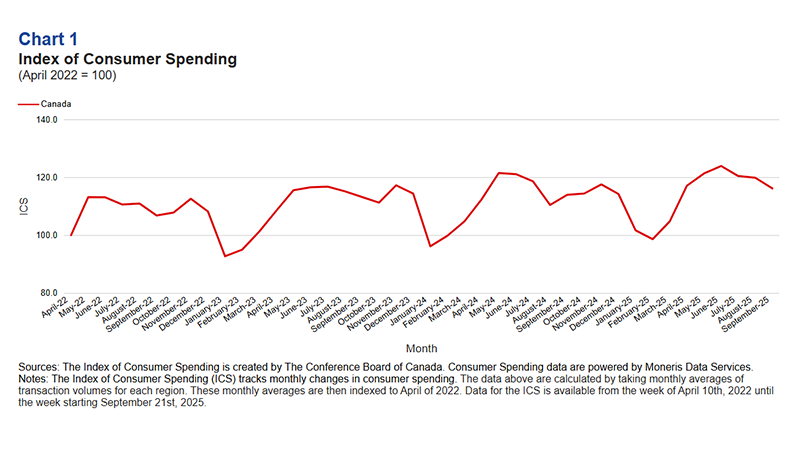

The Index of Consumer Spending falls in the third quarter of 2025 as Canadians tighten their wallets

In partnership with the Conference Board of Canada, we are pleased to present the following authoritative insights from their Index of Consumer Spending (ICS) which has been Powered by Moneris® Data Services. Our industry-leading consumer spending data and insights from point-of-sale activity combined with The Conference Board of Canada’s expertise provides a coast-to-coast perspective on how the economy is trending.

ICS Falls in the Third Quarter Amid a Softer Labour Market and Major Purchase Hesitation

- The Index of Consumer Spending (ICS) averaged 118.8 points in the third quarter of 2025—a slight decline from 120.8 points last quarter.

- The ICS fell each month in the third quarter. In July, the ICS stood at 120.4 points (down from 123.9 points in June) and ended at 116.1 points by the end of September.

- Starting this September, Canada lifted retaliatory tariffs across most U.S. goods. The removal of these tariffs has eased some of the nominal price increase these goods have experienced in 2025 and contributed to a lower ICS score for the month.

- From July to September, Canada’s employment fell by 47,000 nation-wide. The unemployment rate increased to 7.1 per cent.

- Inflation accelerated to 2.4 per cent in September, the second highest rate this year, only behind February’s 2.6 per cent. Over the third quarter, two of consumers’ largest spending categories—groceries and shelter—saw inflation move in separate directions diverging inflation changes. For groceries, inflation accelerated each month with food prices rising by 3.3 per cent in July, followed by a 3.4 per cent increase in August, and a 3.8 per cent increase in September. Meanwhile, for shelter, inflation eased from 3.0 per cent in July to 2.6 per cent by September.

- Statistics Canada’s unadjusted retail sales data averaged $73.3 billion in the second quarter of 2025. Comparatively, currently available data for the third quarter has retail sales averaging only $73.0 billion on a monthly basis. Motor vehicle and parts dealers retail sales have so far increased each month of the third quarter (the only subcategory to do so), reflecting the impact of Canada’s and the United States’ automotive tariffs on consumer prices.

Key Insights

Consumer confidence remains low.

Overall consumer confidence remains weak, with The Conference Board of Canada’s Index of Consumer Confidence averaging a muted 60.8 points over the third quarter. Consumers are especially worried about their financial situation, with almost 60 per cent of consumers expecting their finances to worsen over the next six months. In addition, almost 60 per cent of consumers thought that it was a bad time to make a major purchase. This is likely making consumers more selective in their spending decisions, opting for less discretionary spending and more saving out of precaution, which played a significant role in this quarter’s weaker ICS results.

The Atlantic 'stay-cation' boom defies national trend.

Despite the national dip in the ICS score, the Atlantic provinces—Nova Scotia, Prince Edward Island, Newfoundland and Labrador, and New Brunswick—all recorded a higher ICS in the third quarter, demonstrating a strong regional showing fuelled by the continued 'stay-cation' trend. Since the escalation of Canada’s trade dispute with the United States earlier this year, Canadian travellers have been put off U.S. travel. Despite an 8.6 per cent increase in Canadians returning from oversea trips, travel data for August showed that the number of Canadians returning from the U.S. fell by 29.7 per cent year-over-year.

August also marked the seventh month in a row where U.S. travel by Canadians had fallen. Many Canadians who opted out of U.S. trips have instead decided to travel within Canada, leading to a boom in the tourism industry, particularly in the Atlantic provinces. Data from Airbnb on bookings by Canadians in the first half of 2025 indicated that bookings nationally increased by 10 per cent. Bookings for small towns and provinces was especially strong such was the case in PEI and Newfoundland and Labrador where both saw increases of more than 20 per cent year-over-year. This momentum is expected to have continued into the third quarter, indicated by the Tourism Industry Association in P.E.I. stating that July tourism was busier on a year-over-year basis, and notable events such as the Canada Games in Newfoundland and Labrador in August.

About The Conference Board of Canada:

The Conference Board of Canada is the country’s leading independent research organization. Our mission is to empower and inspire leaders to build a stronger future for all Canadians through our trusted research and unparalleled connections.