The Role of Consumer Spending Data in Decision Making During Economic Uncertainty

Not since the onset of the pandemic in March 2020 have consumers and businesses faced this level of economic uncertainty. In times like these, shifts in consumer spending behaviour can be difficult to anticipate. That’s why researchers and business leaders look for early indicators that can help guide strategy and support decision-making.

The accuracy of research conclusions is directly proportional to the reliability of the data inputs. So, one of the major challenges every researcher struggles with is how and where to source trusted and reliable data.

In consumer spending research, a statistically relevant sample should include consumer spending results spanning all credit card brands from all issuing banks, and it must include debit transactions. Debit transactions comprise an enormous share of spending, especially here in Canada. Researching only credit spend, or only debit spend, is to ignore half of the story willfully. And basing research conclusions on a single bank-issued credit card brand is akin to studying shoe sales using Adidas sneakers as the only data point. So, it is imperative that researchers source large samples of trusted consumer spending data with minimal bias toward card type or card brand.

When a research objective demands a card-agnostic data source, Moneris data delivers results to support high-leverage research applications related to economic research, digital commerce research, domestic and foreign tourism research, and research to support digital marketing strategy (audience creation and digital targeting). For now, let’s discuss research related to the current economic uncertainty.

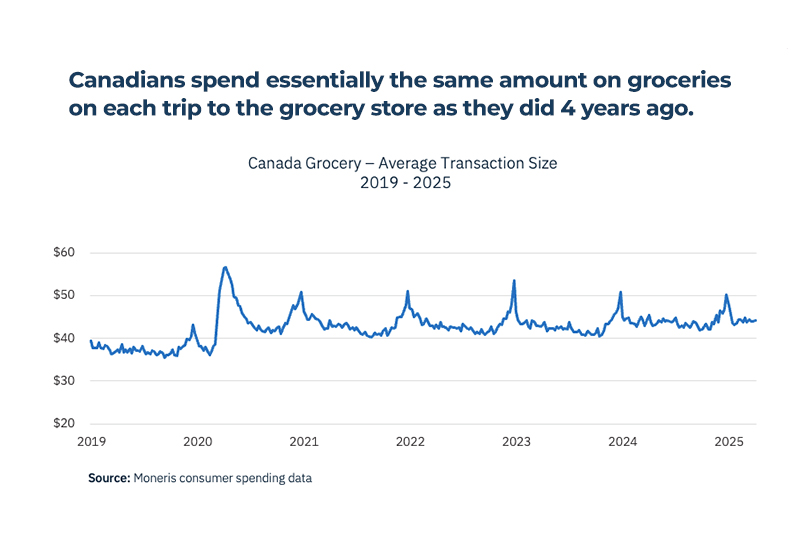

It might surprise you that Canadians spend essentially the same amount on groceries on each trip to the grocery store as they did 4 years ago. This is despite a period of double-digit food inflation. Common explanations include the “substitution effect,” where financially stressed consumers switch to cheaper brand alternatives to save money. They are spending more time hunting for deals. I have also listened to theories that consumers are pulling back on the volume of perishables they might buy in a single trip to eliminate waste if the product spoils before they consume it, thereby saving money. As revealed by consumer spending data, the bottom line is that Canadian consumers are adaptable and have responded to food inflation in surprising but logical ways.

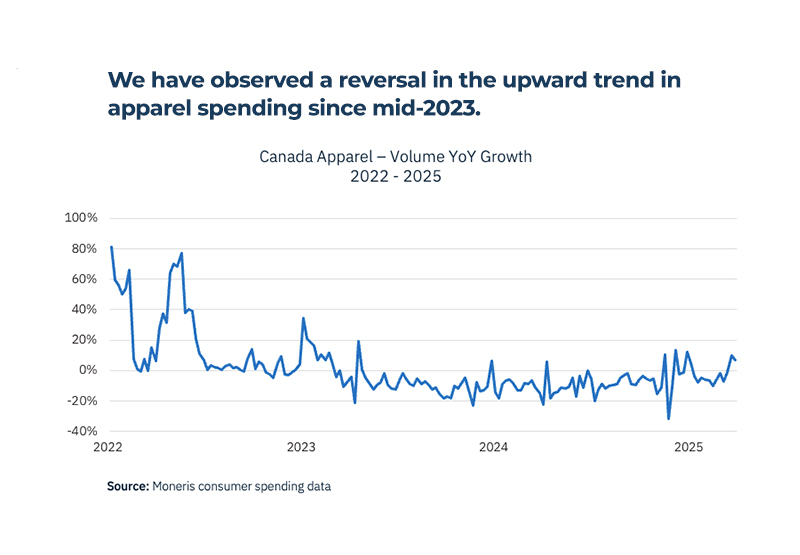

Using Moneris consumer spending data, we have also observed a reversal in the upward trend in apparel spending since mid-2023. For this measure, we look at “dollar volume growth” within the apparel category, which measures the aggregate dollar volume of all payment cards processed by Moneris in the category. In early 2023, year-over-year dollar volume growth in apparel turned negative and stayed that way in all but 3 of the next 78 weeks. Recently, Moneris data has revealed encouraging signs of life in this group nationally. However, recent Canadian anxieties related to cross-border trade and the knock-on effect for consumers may yet cool the upward trajectory of this group.

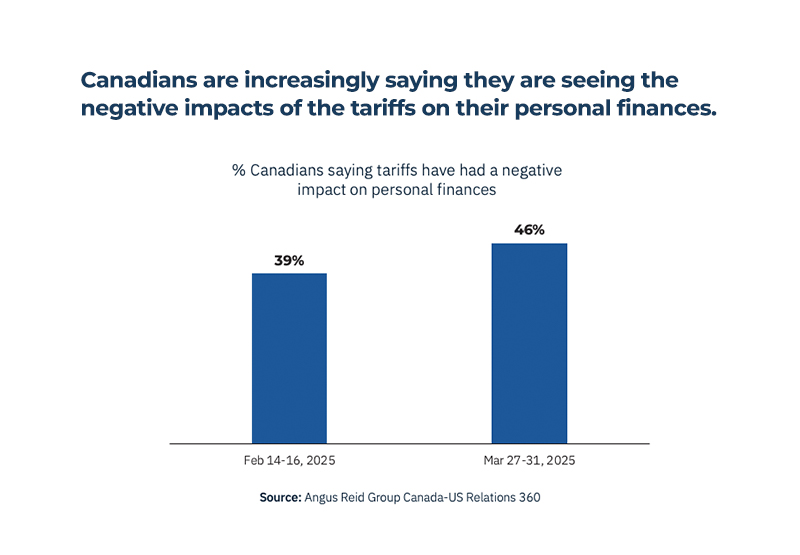

We are about to find out how Canadian consumer sentiment will impact purchase decisions. A recent Angus Reid Survey revealed that 46% of Canadians believe tariffs will hurt their finances. Whether or not that holds true and to what degree remains to be seen. But we know for sure that how rich or poor you feel at the moment you are considering a purchase has a profound impact on the purchase outcome.

Consumer spending data has helped researchers learn, or perhaps reminded them, that consumers are adaptable when it comes to spending. Researchers, economic developers, and businesses who capture this moment of economic uncertainty and successfully forecast the thinly charted path ahead will emerge from the moment ahead of the pack. And make no mistake, history shows that periods of economic uncertainty are usually short-lived, no matter how hot the moment might seem. Data is the change you don’t see coming.